6 Easy Facts About Hard Money Atlanta Described

Wiki Article

The Basic Principles Of Hard Money Atlanta

Table of ContentsThe Ultimate Guide To Hard Money AtlantaThe Best Guide To Hard Money AtlantaA Biased View of Hard Money AtlantaHard Money Atlanta Things To Know Before You BuyThe Ultimate Guide To Hard Money Atlanta

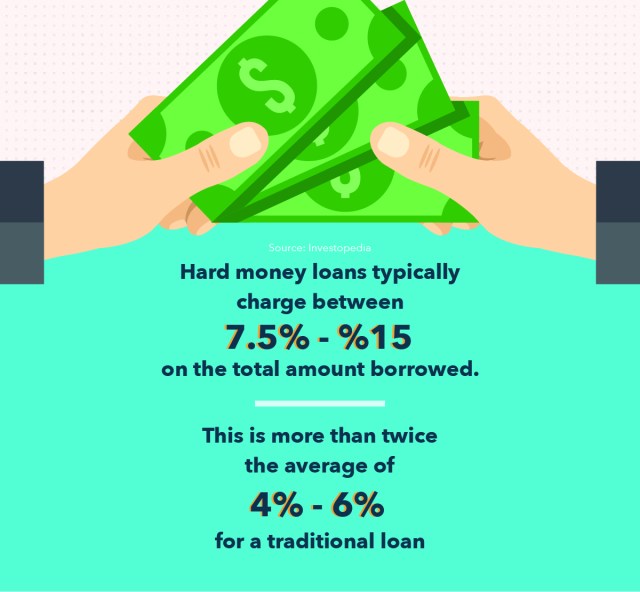

A certain capital buffer is still needed. Hard money loans, often referred to as bridge fundings, are temporary lending tools that actual estate investors can use to finance an investment task. This kind of car loan is commonly a tool for home fins or realty developers whose objective is to restore or develop a residential property, then offer it for a revenue. There are two main disadvantages to consider: Tough money loans are practical, however investors pay a rate for borrowing in this manner. The rate can be as much as 10 percentage points more than for a conventional lending. Source fees, loan-servicing fees, and also closing costs are also likely to cost capitalists more.

All About Hard Money Atlanta

Again, loan providers may enable financiers a bit of freedom right here.

Hard cash financings are a great suitable for rich investors that need to obtain funding for an investment property rapidly, with no of the bureaucracy that goes along with bank funding (hard money atlanta). When reviewing tough cash lending institutions, pay very close attention to the fees, rate of interest, as well as car loan terms. If you finish up paying excessive for a difficult cash financing or cut the settlement duration too brief, that can affect exactly how rewarding your real estate endeavor is in the long term.

If you're looking to acquire a house to flip or as a rental residential property, it can be testing to obtain a traditional home loan - hard money atlanta. If your credit report isn't where a standard lending institution would certainly like it or you require cash quicker than a lending institution is able to offer it, you can be out of luck.

The 8-Minute Rule for Hard Money Atlanta

Difficult money financings are temporary safe finances that make use of the building you're purchasing as security. You won't discover one from your financial institution: Difficult cash finances are provided by alternative lenders such as specific financiers and exclusive companies, that generally overlook average credit history this contact form and also other monetary elements and also rather base their decision on the building to be collateralized.Tough money finances offer numerous advantages for customers. These consist of: Throughout, a difficult money loan may take simply a few days. Why? Difficult cash lending institutions tend to place more weight on the value of a residential or commercial property made use of as collateral than on a debtor's finances. That's because tough money lending institutions aren't called for to follow the exact same regulations that conventional lending institutions are.

It's essential to take into consideration all the perils they expose. While hard money loans featured benefits, a debtor has to likewise take into consideration the risks. Among them are: Hard money lenders typically charge a higher interest price since they're presuming more threat than a conventional lending institution would certainly. Once more, that's as a result of the risk that a difficult money lending institution is taking.

Hard Money Atlanta Things To Know Before You Get This

All of that adds up to suggest that a difficult money funding can be a pricey way to borrow cash. hard money atlanta. Making a decision whether to get a hard money funding depends in large part on your scenario. Regardless, make certain you evaluate the risks as well as the costs before you join the dotted line for a hard cash car loan.You certainly do not intend to shed the loan's collateral since you weren't able to keep up with the month-to-month payments. In enhancement to shedding the possession you advance as collateral, back-pedaling a tough cash financing can lead to significant credit rating harm. Both of these results will leave you even worse off monetarily than you remained in the initial placeand may make it a lot harder to obtain again.

Examine This Report about Hard Money Atlanta

It's vital to think about aspects such as the lending institution's credibility and passion prices. You might ask a trusted genuine estate representative or a fellow residence flipper for suggestions. When you've nailed down the right tough cash lending institution, be prepared to: Think of the down settlement, which normally is heftier than the deposit for a conventional home mortgage Collect the necessary paperwork, such as evidence of earnings Possibly hire an attorney to discuss the regards to the finance after you have actually been authorized Map out a strategy for paying off the car loan Equally as with any kind of lending, review the pros and also disadvantages of a hard cash loan before you devote to borrowing.Regardless of what kind of financing you select, it's most likely a good idea to examine your totally free credit rating and free credit history record with Experian to see where your finances stand.

When you listen to words "tough money finance" (or "private cash finance") what's the first point that experiences your mind? Shady-looking lending institutions who conduct their business in dark alleys and fee overpriced rates of interest? In previous years, some bad apples tarnished the tough money providing sector when a few aggressive loan providers were trying to "loan-to-own", providing really dangerous fundings to borrowers making use of property as security and meaning to seize on the residential properties.

Report this wiki page